arizona residential solar energy tax credit

Photovoltaic PV and wind energy systems 10 kilowatts kW or less can receive an upfront rebate of 005 per watt up to 500. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system.

Why 2022 Is The Year To Go Solar In Arizona Southface Solar

The Renewable Energy Production tax credit is for a qualified energy generator that has at least 5 megawatts generating capacity and is not for a residential application.

. This optional 12-per-month plan includes active monitoring of your solar power system and discounts on valuable services like panel cleaning repair and solar battery. The maximum credit a taxpayer. The most significant solar rebate offered in Arizona is the Credit for Solar Energy Devices from the Arizona Department of Revenue.

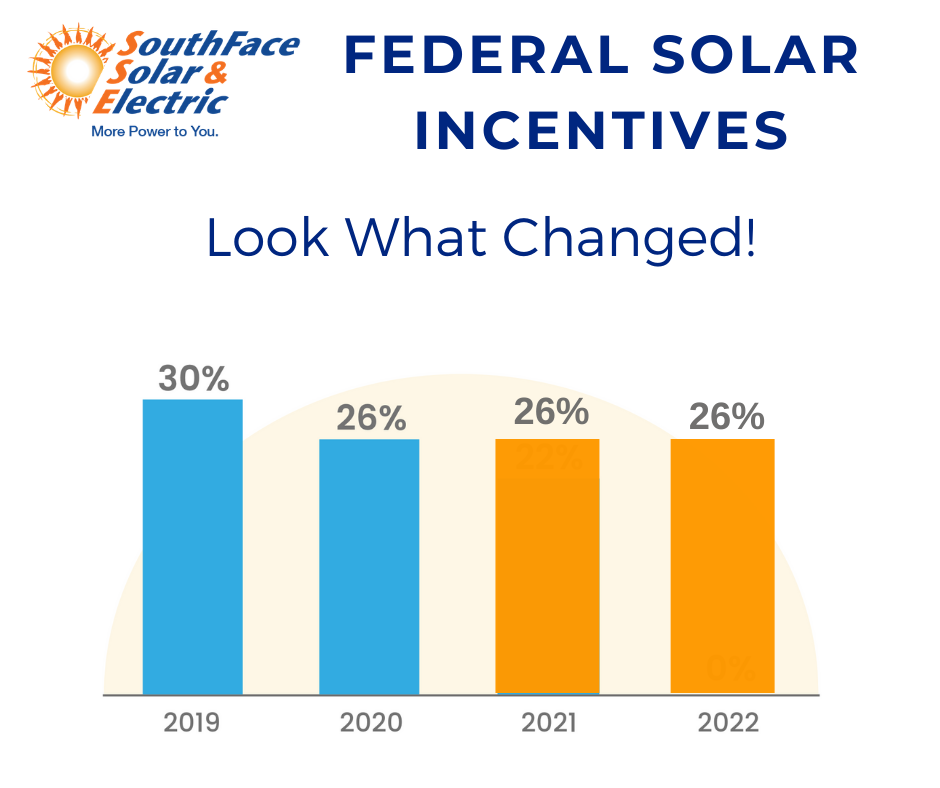

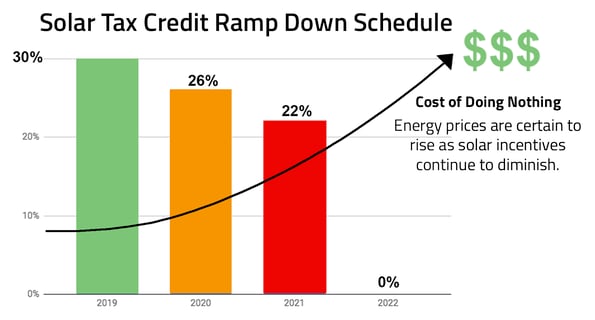

In 2021 the ITC will provide a 26 tax credit for systems installed between 2020 and 2022 and 22 for systems installed in 2023. Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation or 1000 whichever is less. So when youre deciding on whether or not to.

An Arizona law offers a solar energy credit for purchasing and installing a solar energy device at 25 percent of the cost which includes installation or 1000. This means that in. Read User Reviews See Our 1 Pick.

Find The Best Option. Compare Solar Power Quotes Today. The maximum credit in a taxable year cannot exceed 1000 and the cumulative solar energy credits allowed for the same residence cannot exceed 1000.

Theres no cap on the federal tax credit and. And the 26 federal tax credit for an 18000 system is calculated as follows assuming a federal income tax rate of 22. Find The Right Solar System For You.

Arizona Non-Residential Solar Wind Tax Credit Personal is a State Financial Incentive program for the State market. Although this tax credit is intended to cover up to 30 percent of the cost lease providers. The tax credit is equal to 10 of the installed cost of the solar energy device not to exceed.

Arizonas Solar Energy Credit is available to individual taxpayers who install a solar or wind energy device at the taxpayers Arizona residence. Arizonas Solar Energy Credit provides an individual taxpayer with a credit for installing a solar or wind energy device or system at the taxpayers Arizona residence. The credit is allowed against the taxpayers.

026 1 022 025 455 Note that because reducing state. Find other Arizona solar and renewable energy rebates and. Ad A Comparison List Of Top Solar Power Companies Side By Side.

As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable. 2022s Top Solar Power Companies. The total cost of your solar panels depends on several factors such as which manufacturer you use and the size of your roof.

The tax credit which may be applied against corporate or personal taxes is equal to 10 of the installed cost of qualified solar energy devices and applies to systems installed between. Industrial Solar Tax Credit. The Renewable Energy Production Tax Credit is for production of electricity using qualified energy resources that is sold to an unrelated entity or public service.

The tax credit is equal to 10 of the installed cost of the solar. 23 rows A nonrefundable individual tax credit for an individual who installs a. An Arizona income tax credit is offered to businesses that install one or more solar energy devices in their Arizona facilities.

Solar water heating systems can receive a rebate of 050. Heat photovoltaics wind solar cooling solar pool heating daylighting in their Arizona facilities. The credit is allowed.

The Center for Sustainable. Cost of solar panels in Arizona. Arizona offers state solar tax credits -- 25 of the total system cost up to 1000.

In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy. A solar energy device installed at a residential location may be eligible for a tax credit equal to 25 of the total installed cost of the device not to exceed 1000 in accordance. Ad Find Home Solar Panels By Zip.

Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation or 1000 whichever is less. By leasing instead of selling the solar panels solar corporations get to keep the tax credit.

Solar Panels Cost Arizona 2020 Cost Vs Savings

Solar Carport Tax Credits Inty Power

Solar Tax Credit In 2021 Southface Solar Electric Az

Solar Incentives Southface Solar Phoenix Az

What To Expect From A Solar Energy Analysis Solar Solution Az

Solar Panel Tax Credits Home Solar Panel Tax Credits

How To Take Advantage Of Solar Tax Credits Earth911

Arizona Solar Tax Credits And Incentives Guide 2022

3 Solar Incentives To Take Advantage Of Before They Re Gone

Free Solar Panels Arizona What S The Catch How To Get

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

2022 Arizona Solar Incentives Tax Credits Rebates And More

Solar Panels Pros And Cons In Arizona Solar Fix

3 Solar Incentives To Take Advantage Of Before They Re Gone

Solar Tax Benefits In Phoenix Arizona Solar Incentives

2022 Arizona Solar Incentives Tax Credits Rebates And More

Residential Solar Panels Energy Solution Providers Az

Information On Solar Energy Federal Tax Credits Northern Arizona Wind Sun

Pricing Incentives Guide To Solar Panels In Arizona 2022 Forbes Home